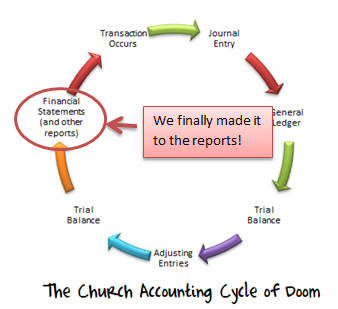

Phew! We finally made it to the financial reports (the main reason we’re doing all this accounting in the first place). Today we’ll learn about the statement of financial position (one of the most important financial statements a church can create). At the beginning of these lessons we talked about keeping the end goal in mind as you studied the Church Accounting Cycle. Well, I’m happy to report that we’ve arrived (the goal being to create reports for the church board of trustees and any independent third parties who want to see your church’s financial statements).

Why Are Financial Reports Important?

You can go here for a great, in-depth read on why financial statements are important for churches.

Basically, the church board of trustees (especially the finance committee) can use these reports to look at how the church is doing financially. They can then use these reports to make important decisions about the future of your church. These decisions can be critical to the overall health of your church! Churches need wise financial managers in order to survive.

Your church may need these reports in order to get a grant or a loan. Banks will require these financial statements if your church is trying to get a loan. If the statements are audited by a CPA, then your statements look even better to the bank.

Now that we know why these statements are important, let’s get back to talking about the statement of financial position.

The Statement of Financial Position

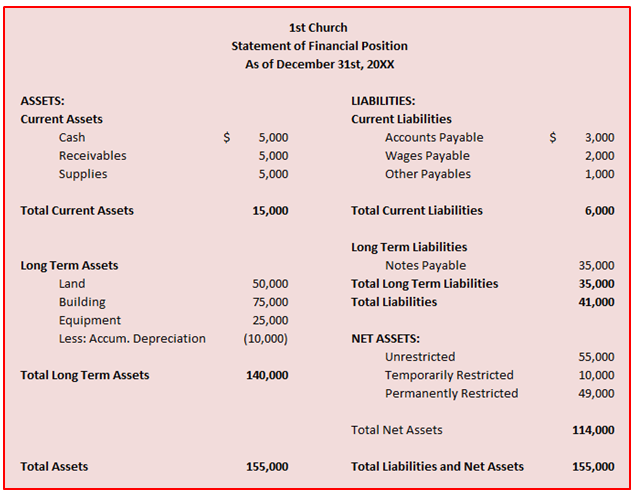

For-profit companies call this statement the balance sheet, but I personally believe the statement of financial position is a more descriptive name (and it just happens to be the name used by churches and other nonprofits). This report is designed to show the overall financial position of your church. It does this by listing out all of your church’s assets, all of your liabilities, and then it subtracts liabilities from assets to clearly show the reader whether your church has more assets or more liabilities. Can you see how this information would be useful to a bank? I sure hope so. I mean, if you’re going to lend someone money you want to make sure they’re going to be able to pay it back at some time in the future. If they already have more debt than they have assets, then it’s more risky to lend to them, and many banks won’t do it.

Take some time to look over the statement of financial position example pictured above. We’ll talk about its features below.

Current Assets – Starting in the top left of the statement we see current assets listed. Current assets are all the assets or resources your church owns that will likely be converted into cash or used up within the next year. Common examples of this type of asset include cash, any receivables your church might have, and supplies that will be used within the next year.

Long Term Assets – Long term assets are all those assets that won’t be used up or converted to cash within the next year. Common examples include your church’s land, building(s), and equipment.

At the end of the first column, you sum up all of the assets into a category called total assets.

Where do the Numbers Come From?

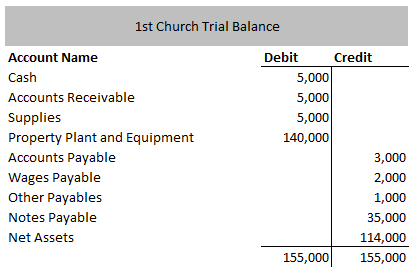

You probably notice in the above example that cash has a balance of $5,000. Where did the accountant get that number? Did he simply count up cash at the end of the year and then write it in? Unfortunately, accounting is not that simple. While this ‘counting up’ method might work for cash, it won’t work for supplies and other assets. Can you imagine counting all your supplies, buildings, cash, and other assets each time you needed a report?

The good news is that these numbers come from the Church Accounting Cycle or system we’ve been talking about. The numbers are simply taken from the post-adjustment trial balance (that we talked about in lesson 12) and posted to the appropriate account name (known as a line-item) on the statement of financial position. This means that if you’ve been doing all your accounting during the year, then the end of the year can be relatively painless and inexpensive; just copy and paste the information over to your reports!

Of course, church accounting software will do this all for you, if you’ve entered the transactions correctly. Look at the trial balance pictured below and then look at the statement of financial position above. Can you see where the numbers have simply been copied and pasted to the statement of financial position?

Remember that these numbers on the trial balance come from the balances on the individual general ledgers or T-Accounts discussed earlier. Hopefully you’re starting to see how this cycle works! It’s pretty neat, actually.

Below is a massive sentence (probably with a few grammatical issues) that sums up nicely everything we’ve learned to this point.

A transaction occurs, a journal entry is recorded, the numbers from the journal entry are posted to the ledgers, the numbers from the ledgers are posted to the trial balance, adjusting entries are made, the trial balance is updated, and the numbers from the updated trial balance are copied and pasted over to the financial reports.

Read that sentence over a few times and make sure you understand it. If you understand that sentence, then you understand the accounting process and you’re officially an accounting genius.

Now that you know where these numbers are coming from, let’s get back to understanding everything on the statement of financial position.

Liabilities

In the right column of the statement above, you have all your church’s short-term and long-term liabilities.

Current Liabilities are all the liabilities that your church expects to pay off in the next year. Common examples include accounts payable to suppliers and wages payable.

Long-Term Liabilities are all the remaining liabilities that your church doesn’t expect to pay off in the next year. A common example is a mortgage payable, often called a note payable.

Why the Separation Between Current and Long-Term?

One common question among those learning church accounting for the first time is, “Why do we have to separate current and long-term assets and liabilities?” Separating these items helps the user of the report see how capable your church is of meeting its current debts. If your church has more current liabilities than current assets, this is generally considered a bad sign because it means your church will have a hard time paying off its debts that come due during the next year.

Net Assets

If you’ll remember back to the famous accounting equation (assets = liabilities + net assets) you’ll see that the statement of financial position is based off of this equation. After all the assets and liabilities are listed, the net assets are listed. The net assets are simply the surplus of assets your church has over liabilities. Assets – Liabilities = Net Assets.

If your total liabilities are greater than your total assets, then you have negative net assets… and that’s a bad thing. Best to avoid that if possible. 🙂

Note that your church should list net assets in three different categories or funds: unrestricted, temporarily restricted, and permanently restricted.

Final Words on this Statement

Hopefully you notice the perfect balance that takes place in accounting. At the end of the statement of financial position, you should note that the value of total assets is equal to the value of total liabilities + net assets. This balanced world has caused many people to become accountants.

Balance in both life and in accounting is good.

Summary

The statement of financial position shows the financial position of your church. It’s divided up into three main categories (assets, liabilities, and net assets). Assets and liabilities are classified as either current or long-term. This helps readers of the report understand whether the church will be able to pay off its debts in the next year. Net assets are categorized as unrestricted, temporarily restricted, or permanently restricted. In the next lesson we’ll be discussing the statement of activities in detail.