Recently, a lot of questions have arisen about the usefulness of QuickBooks as church accounting software. The following is an unbiased review of using QuickBooks for your Church's accounting.

Recently, a lot of questions have arisen about the usefulness of QuickBooks as church accounting software. The following is an unbiased review of using QuickBooks for your Church's accounting.

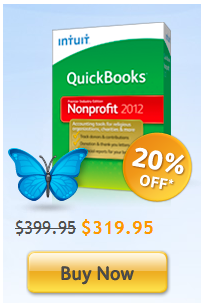

QuickBooks has multiple versions of accounting software. They don't have any software that is specifically named "Church accounting software." They do however have a QuickBooks Nonprofit Edition. This edition is very popular among churches and non-profits. According to several surveys from The CPA Technology Advisor about 70 percent of non-profits use QuickBooks. At least one CPA I have communicated with thinks that this number is closer to 90 percent for churches. In other words, a majority of churches are using this software for accounting purposes. The premium nonprofit version (as opposed to the normal version) would probably be the best to use for your church's accounting system, although some churches get away with using normal QuickBooks, known as QuickBooks Pro.

Advantages of Your Church Using QuickBooks

The number one advantage of using QuickBooks NonProfit for your church's accounting is its ease of use. Many people, even those without much of an accounting background, are able to use QuickBooks effectively. A learning curve does exist, but it isn't as large a curve as trying to learn a specialized church accounting software system.

To make things easier for those of you who decide to use QuickBooks Nonprofit, I have created a step-by-step guide to using QuickBooks for churches called the QuickChurch Accounting Course (you can read more about it by following that link).

Another advantage of using QuickBooks is its customer support. When we mention customer support, we are not necessarily talking about the people at Intuit who designed the software (although they are excellent). Chances are you know someone who is already quite familiar with QuickBooks. Imploring them to help you set up and run QuickBooks as your church accounting software might be the best route for your church.

One final advantage that should be mentioned is the QuickBooks Online Payroll option. This service is well worth the cost for most churches. Let's face it, most church staff don't really have a clue how payroll works or how time consuming it can be. If you use this online service, QuickBooks will do the hard work for you (direct deposit, W2 calculations, tax help, and customer support for the questions that you're bound to have). Intuit Online Payroll Easy to Setup and Use. Try Now FREE for 30 Days. QuickBooks has standard payroll software if you're interested in that as well.

Disadvantages of QuickBooks

**Update** It appears that Intuit has fixed the audit trail problem mentioned below and it is no longer a disadvantage for nonprofits. Several users have even claimed QuickBooks audit trail is among the best: see comment section for further discussion. ***

In the past QuickBooks didn't leave much of an audit trail in some situations. If an error was made by your church accountant, then he/she could easily reverse the error without leaving any evidence. This is no longer a problem. Errors can be corrected easily, but the software does a great job of leaving an audit trail documenting what actually occurred.

You may be thinking that being able to easily correct errors is something you want in your church accounting system. The downside of this is that it can be easily manipulated. Most church accounting software requires an adjusting entry when an error is made. This leaves what is called an audit trail so that a church auditor, loan officer, or banker can look back and see any adjustments made throughout the year.

A skilled church accountant could easily cook your church accounting books if proper internal controls are not in place. QuickBooks now has these controls in place and is now very safe to use as church accounting software.

One disadvantage of using QuickBooks Professional instead of QuickBooks Non-Profit is that it was originally designed for businesses, not churches. Intuit's non-profit software will make it easy to support your church's reporting requirements, but QuickBooks Pro may not support your church's reporting requirements or terminology.

In Review:

- QuickBooks can be used for your church's accounting (some estimate that 90% of churches are using this software)

- Advantages include ease of use and great customer support ( a lot of people know how to use this software)

- Disadvantages include the fact that this software was originally designed for businesses. This was a larger problem when Intuit didn't have a special version for not-for-profits.

Helpful Resources:

How to Create a Year-End Donor Summary Statement in QuickBooks

The QuickChurch Accounting Course: Don't know anything about church accounting? No problem. This course will get your church accounting system up and running in no time.

I just bought the programme but did not get the link to start?

Our non-profit is currently using QB Pro 2007. Must we upgrade to the newer version to take advantage of the non-profit industry settings? If we do upgrade is it possible to import or convert from our current version or must we begin new?

Hello Nate,

I’ve downloaded your book and it’s been very helpful to me. I am a bookkeeper for a church and I’ve adopted your ways of keeping the books simple. I just have a few questions.

Question #1: Does Cash Account classification of Unrestricted, Temporarily Restricted and Permanent Restricted Bank Funds need to be synced with Contribution Revenues classification as well? Another words, does Contribution Revenues Acct (Income) need to be classified with Unrestr, Temp Restri and Perm Restricted as well?

Question #2: When receiving a donation for multiple funds, you say to leave the top class box empty but fill in the bottom class field. But the donation reads ‘unclassified’ on the donor summary report. Is there a way to record the donation allocating it to multiple funds with one transaction without having to enter each individual transaction separately; with having to show each allocated contribution individually on the donor summary report?

Thank you,

God bless,

Andrew Villarreal

What’s up, its good post on the topic of media print, we all know media is a enormous source of data.

Quality content is the secret to be a focus for the visitors to

visit the site, that’s what this web site is providing.

If you have QuickBooks Premiere for non-profits and use the on-line version, would you be required to use the online version of Intuit Payroll or can you use the desktop version of the payroll system?

Is the ebook only for QuickBooks for Non-profits, or is it also for QuickBooks Pro? I’m just starting, but I believe our church uses QuickBooks Pro online.

Hey Carmen,

The ebook/course is designed for QuickBooks for Non-profits. However, lots of people have taken the course using QuickBooks pro or QuickBooks online. The course is still really helpful for these people, but it’s not quite the slam dunk that it is for those who use QuickBooks nonprofit. Hope that makes sense.

Nate

Hi We are a Native American Church with a Degree Granting Seminary for Members or Students. We also operate on Mac computers. WE are looking for an easy accounting program that allows us to track the following Student tuition Donations for Seminary programs, Member dues, tithes and payables. Do you have any ideas? We are open to any suggestions we currently do all our accounting by hand; we are growing the school and church. Thank you, Julie

Hi Julie,

I know QuickBooks has a Mac version, but it isn’t designed for nonprofits. It’s probably still worth taking a look at. I’ve never used a Mac so I don’t really have any good advice. Maybe someone else will have a better idea.

I found a Mac version and it was worthless. Granted this was a couple years ago, but I have heard no good news re it. I use QBPro for the shelter and it has been great as I had a pro bono cpa who I could call at any time.

needing to know if the NON Profit software can do budgets for different depts in a church?

Hey Susan,

Yeah it can do that as long as you set up the accounting system correctly.

Best,

Nate