In the last lesson we talked about how to make the 1st Church statement of activities look like the statement of activities shown in FAS 117. Today we’ll work on doing the same for the statement of financial position.

FAS 117

The main push in FAS 117 is to classify net assets according to the three categories: unrestricted, temporarily restricted, and permanently restricted. Other than that, the statement of financial position looks just like a normal balance sheet.

FAS 117 Example:

Getting the net asset account amounts right might seem difficult, but it’s really not bad if you have your system set up correctly (like we have done in this book).

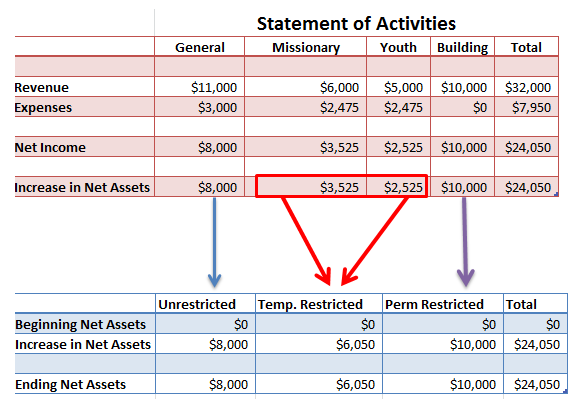

Using 1st Church as an example, you simply take the information from the statement of activities and make a few journal entries (shown further below). Remember that the missionary and youth programs are simply temporarily restricted funds.

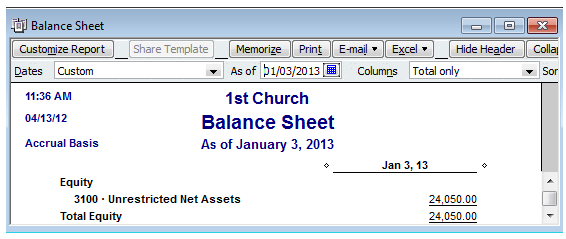

If I pull up the standard balance sheet in QuickBooks (Reports >>> Nonprofit Reports >>> Statement of Financial Position) and adjust the reporting date to January 3rd of the next year then I’ll see that QuickBooks automatically allocated all my net income to unrestricted net assets (as shown below). It’s important that you change the date or QuickBooks will simply show you Net Income in the Equity section (instead of unrestricted net assets). This is because at the end of the fiscal year QuickBooks automatically closes out net income to retained earnings (unrestricted net assets) for you.

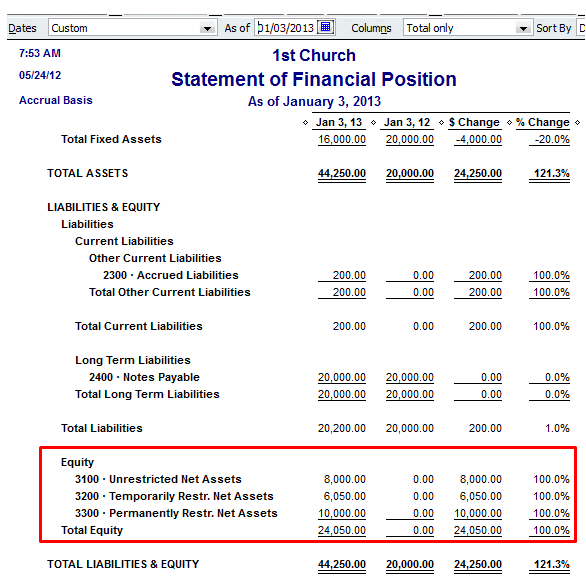

The problem with the report above is that QuickBooks put all the income for the year into unrestricted net assets instead of allocating it out to unrestricted, temporarily restricted, and permanently restricted. To fix this you (or a qualified accountant) will need to make an allocating journal entry. We’ll go ahead and make this journal entry for 1st Church.

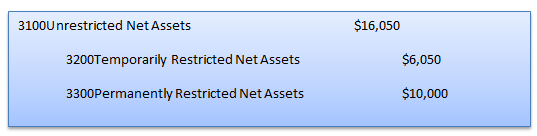

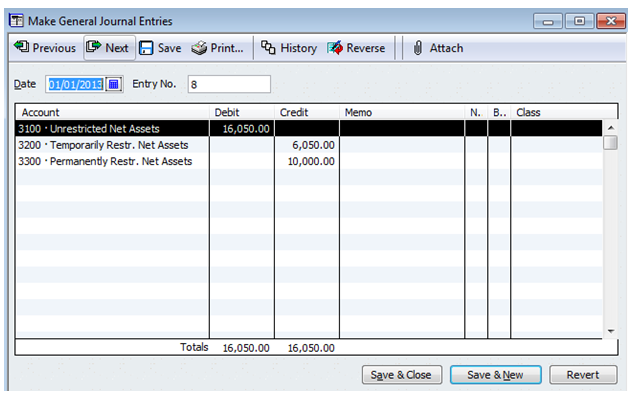

According to the information we generated above 1st Church should have $8,000 in unrestricted net assets, $6,050 in temporarily restricted net assets, and $10,000 in permanently restricted net assets. The journal entry would look like this:

Here’s how it would look in QuickBooks. I would suggest making this journal entry at the end of the reporting period (in this case 1/1/2013).

Your statement of financial position should look like the following after the adjustment.

Conclusion

In this lesson we learned how to create a GAAP-compliant statement of financial position within QuickBooks. Using QuickBooks, you will have to make an allocating entry during the closing procedures at the end of the year.

That wraps up the appendix of this book. As mentioned in Lesson 40 of this book, this book is a living document. If you'd like to see something else discussed please head over to Lesson 40 and mention it there.