So I've received a few questions lately about how to get the basic or enhanced versions of QuickBooks instead of the online versions. The confusion stems from two sources:

1. QuickBooks is pushing people towards the online version.

2. Even the standard CD versions of QuickBooks Payroll are paid for on a subscription basis. The rationale behind the subscription is that the tax rates and forms are constantly being updated by QuickBooks so they are charging for their continuous service.

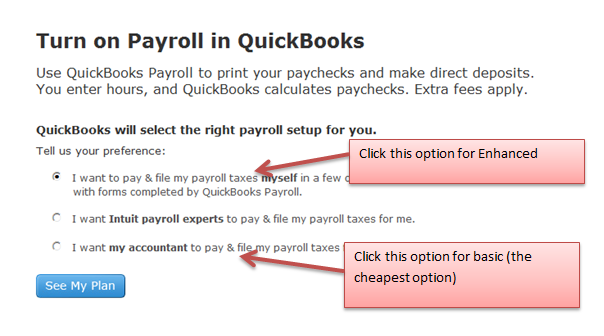

First look for this item within your version of QuickBooks.

Then you’ll see this window.

If you’re looking for the basic option, then you’ll need to click on “I want my accountant to pay and file my payroll taxes.” Your accountant doesn’t actually have to do this for you (many people do this without the help of an accountant).

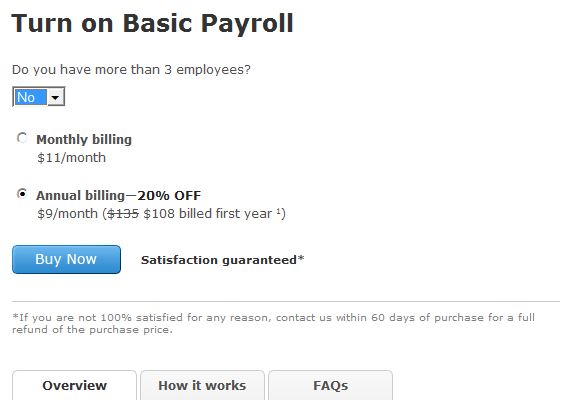

Then you’ll see this window.

And there you have it, the basic payroll option.

Leave any questions below.

I have just taken on the treasurer position for a small church in a very quick fashion, as the current treasurer was diagnosed with terminal cancer. Luckily, I am currently a full time finance manager for a very large christian school and am familiar with a good deal of the basic information. It appears they have the three paid employees set up to receive their weekly checks by online banking. All deductions, taxes, withholdings are manually calculated and withheld. This process is free of course, however, as I have worked extensively with QuickBooks Payroll, I would feel more comfortable with them making those calculations and yearly law updates. How do you stand on that issue? Thanks, Nikki

Hi Nate,

Trinity Presbyterian Church began using QuickBooks Nonprofit Edition 2012 this January, 2013. I have QuickBooks experience in all areas except payroll. The church has used PowerChurch Plus software for their financial needs in the past. The Federal/FICA tax deductions were automatically calculated and deducted on the paychecks for our 7 employees. Each year, I would need to download the tax tables from the IRS website into the PowerChurch Plus software. My question is: Without the online QuickBooks payroll services, how do I download the tables and deduct the taxes automatically each pay period?

Hi,

When you go through the payroll setup guide, QuickBooks should run you through this. Did you go through the guide when you purchased the software?

Best,

Nate

Nate,

Yes, I have gone through the setup guide. I noticed the Social Security tax rate still shows 4.2% so I made sure the automatic update was “on” and the payroll option was checked. How can I view the tax tables within the payroll setup?

Thanks so much,

Terry

Hey Terry,

That is weird. I’d consider contacting QuickBooks customer support about that. They offer free support on things like this. Also, take a look at this help article: http://payroll.intuit.com/support/kb/1001166.html.

Do when you activate the payroll option in quick books, which is provided through your course, there is still a fee of $108 for the first year. If you know what is the fee for the following years and how is that being takened out on a monthly basis as shown. Without activatin this feature for payroll it is not originally included into the course?

Hi Geraldine,

Not sure I understand your question. Below is my answer to what I think you’re asking.

First off, the QuickChurch Accounting Course that you can purchase on this site for $30 doesn’t come with the QuickBooks program (you have to buy that separately).

When you purchase QuickBooks program, the payroll function is not automatically activated (you have to purchase it separately). This is because the payroll laws are constantly changing and Intuit has to keep changing the program to keep up with the laws.

After the first year, payroll would cost you about $12 a month (according to the guys I talked with who work for QuickBooks payroll).

Hope that helps and let me know if I answered your question or not.