In the previous lessons we learned two methods for entering expenses into QuickBooks: (1) The direct disbursement method and (2) the billing method. Today we’ll learn how to enter some program specific expenses into QuickBooks.

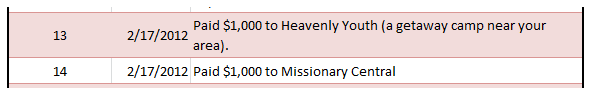

Transactions 13 and 14

Transaction 13

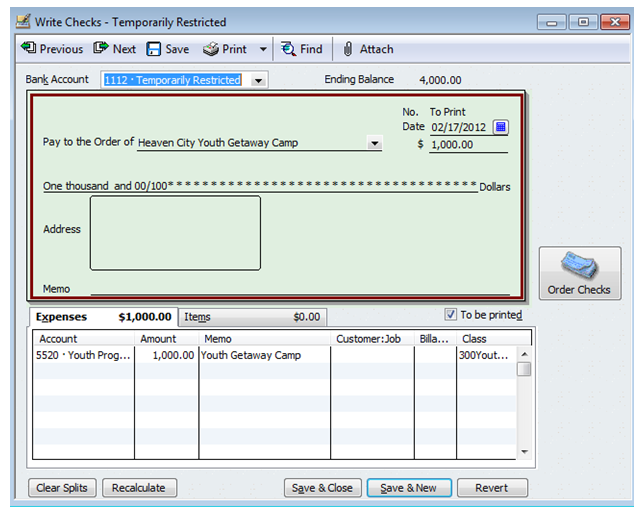

Go to Home Screen >>> Write Checks.

Here’s what your check will look like:

There are three items worth noting on this check. (1). The money should come out of the temporarily restricted bank account. This way you can keep track of how much money is in the account. (2). The account is 5520 Youth Program Expense. (3). Make sure to assign the class to the youth.

Click “Save & New”.

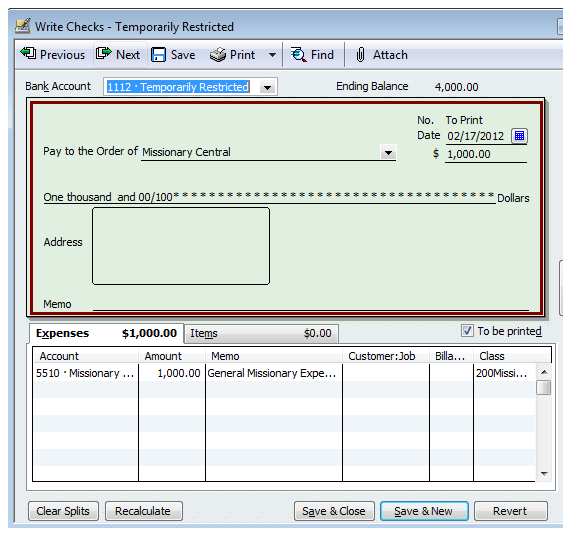

Transaction 14

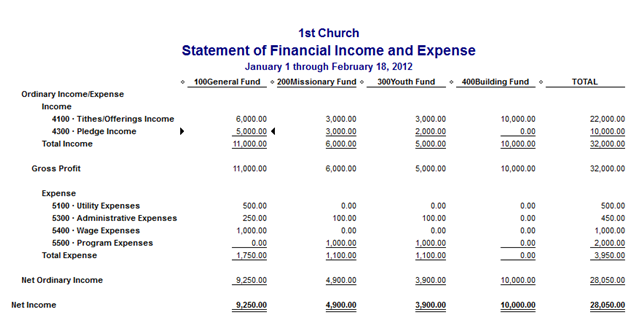

Let’s take a quick look at the statement of activities after running these expenses.

Conclusion

Today we entered some program specific expenses into the software and took a look at 1st Church’s income statement. In the next lesson we’ll briefly talk about payroll.