I get a lot of questions about the tax-exempt status of churches. I’ll attempt to answer some of them in the following paragraphs. If you want to read more in-depth about your church’s tax exempt status, then I’d recommend reading Section 501(c)(3) of the Internal Revenue Code. Also, the gracious people at the IRS also have this amazing publication: The Tax Guide For Churches and Religious Organizations.

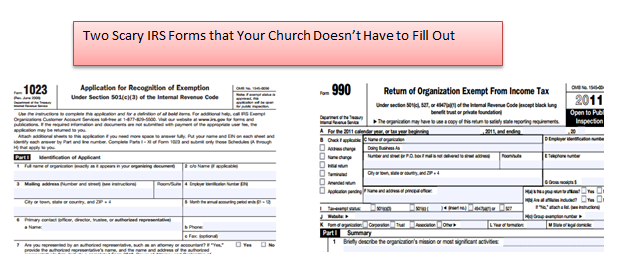

The quick answer to your question is that churches do NOT have to file form 1023 in order to gain tax exempt status. Churches that meet all of the exemption requirements (discussed in depth in the above links) are automatically considered tax exempt.

Some Churches to File for Tax Exempt Status!

With that in mind, some churches do decide to apply for tax exempt status. Why in the world would anyone go through the headache of filling out more paperwork when it isn’t necessary? It makes people feel better. Your church can go through the whole process and pay an $850 fee to be officially recognized by the IRS as Tax Exempt. This makes some church leaders and contributors sleep better at night knowing that the IRS official recognizes them as tax exempt. It’s one of those things that isn’t necessary, but makes you feel more secure.

Does my Church have to File form 990?

The short answer to this question is no churches do NOT have to file form 990 (again, if you want all of the nitty-gritty you should read the IRS publications I listed above). Churches are exempt from having to file form 990, 990-EZ, or 990-N.

Now, if for some reason your church engages in “income-producing” activities that aren’t related to your church’s tax exempt purpose, then in this case the church does need to fill out form 990T. For example, if your church offers advertising, sells any merchandise, or charges the public for parking you may be required to file form 990 and pay income tax on the money earned from these unrelated business activities. Read pages 16 and 17 of this guide if you’re worried that your church may need to pay Unrelated Business Income Tax.

Conclusion

Fortunately most churches will get to worry about two less things than most nonprofit organizations. Churches don’t have to file form 1023 because they are automatically considered tax exempt. In addition, they don’t have to file form 990. Sometimes it’s good to be a church.

Other Useful Resources:

http://www.irs.gov/charities/churches/index.html

Speak Your Mind

You must be logged in to post a comment.